working capital turnover ratio ideal

Working Capital Turnover Ratio Net SalesWorking Capital. Interpretation of Working Capital Turnover Ratio.

Capital Turnover Definition Formula Calculation

Net Sales Total Revenue - Cost of Sales Returns Allowances Discounts You then calculate the turnover ratio.

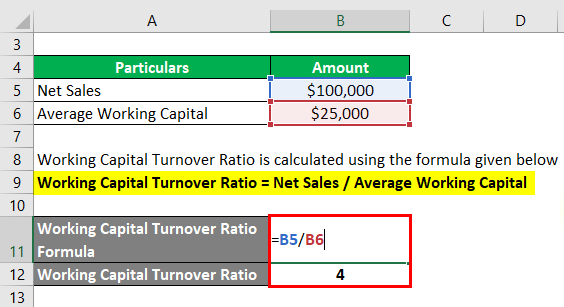

. Ideally the higher the working capital turnover ratio of the business is the better it is considered. Working Capital Turnover Net Sales Average Working Capital. The working capital turnover ratio measures how efficiently a business uses its working capital to produce sales.

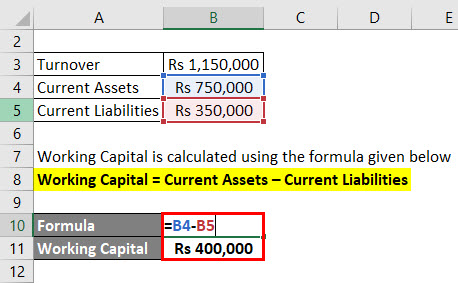

The working capital turnover ratio is thus 12000000 2000000 60. Working capital is current assets minus current liabilities. It indicates that for one rupee of sales the company needs Rs 025 of its net current assets.

Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of. WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover ratio. This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for Commerce students.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. Capital Turnover Ratio 500000 40000 125.

This company has a working capital turnover ratio of 2. The complete information needed to calculate the average working capital is available from the beginningclosing balance sheets. This gap is bridge with bank borrowings and long term sources of funds.

First lets calculate the average working capital. If the result is too high eg more than a ratio of 11 the company you are analyzing might be having trouble converting inventory to sales or not enforcing. Net Working Capital Turnover Sales Net Current Assets 4 times.

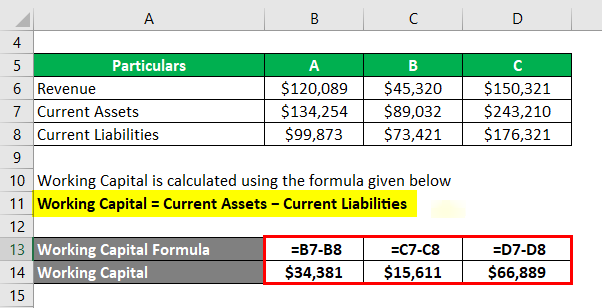

Working capital turnover Net annual sales Working capital. Generally a working capital turnover ratio of 10 means that the company has generated sales of the same value as its working capital. Working Capital Current Assets - Current Liabilities.

This shows that for every 1 unit of working capital employed the business generated 3 units of net sales. Working capital Turnover ratio Net Sales Working Capital. The working capital turnover ratio formula is as follows.

Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on. However where the average is not given for example in financial statements that only show closing balances then these figures may be used. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales.

Working Capital Turnover Ratio Net Annual Sales Working Capital. 15000050000 31 or 31 or 3 Times. A higher ratio indicates greater efficiency.

420000 60000. The working capital turnover is preferred to be above 10 or at least equal to it. Average Working Capital is the ideal figure to use for a more accurate result.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. The average working capital during that period was 2 million. This means that every dollar of working capital produces.

Net Sales Total Assets minus Total Liabilities In this way the amount of sales is directly related to the companys current assets and liabilities. The reciprocal of the ratio will become 025 that is the reciprocal of 41 is 14. Here the working capital formula is.

This means that for every one dollar invested in working capital the company generates 2 in sales revenue. Average Working Capital Opening Working Capital Closing Working Capital 2. In general a high ratio can help your companys operations run more smoothly and limit the need for additional funding.

Therefore we are really looking at how you make the spare capital work and whether its generating enough sales to cover your liabilities. This means that for every 1 spent on the business it is providing net sales of 7. It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company.

What is the Working Capital Turnover Ratio.

Working Capital Turnover Ratios Universal Cpa Review

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Efinancemanagement Com

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Download Scientific Diagram

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template